Infographic: Saving for Your Child's School

*This content is developed from sources believed to be providing accurate information. The information provided is not written or intended as tax or legal advice and may not be relied on for purposes of avoiding any Federal tax penalties. Individuals are encouraged to seek advice from their own tax or legal counsel. Individuals involved in the estate planning process should work with an estate planning team, including their own personal legal or tax counsel. Neither the information presented nor any opinion expressed constitutes a representation by us of a specific investment or the purchase or sale of any securities. This material was developed and produced by Advisor Websites to provide information on a topic that may be of interest. Copyright 2022 Advisor Websites.

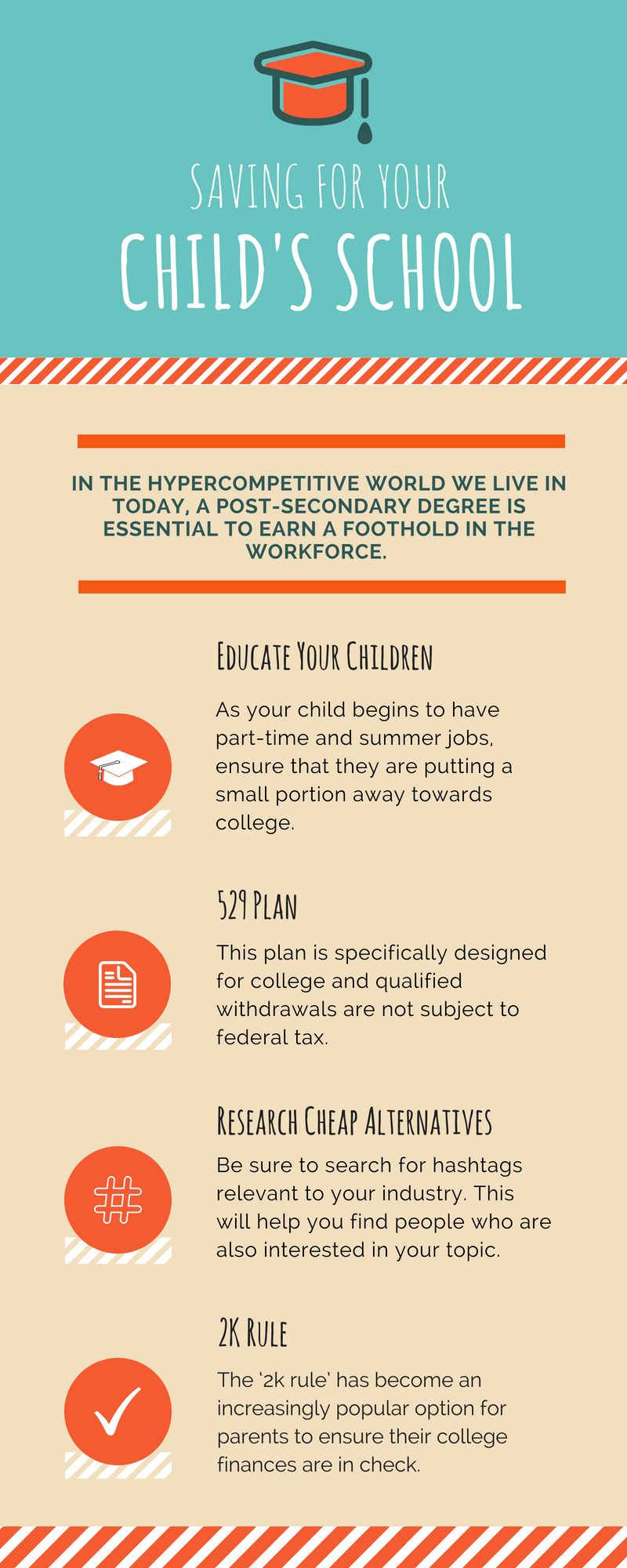

Investors should consider the investment objectives, risks, charges, and expenses associated with 529 plans prior to investing. This and other important information is contained in the fund prospectuses, summary prospectuses and each issuer’s official statement, which can be obtained from a financial professional and should be read carefully before investing.

There is a risk that the investments may not perform well enough to cover the cost of college as anticipated. Investors should also consider whether their state offers any favorable state tax benefits for 529 plans, and whether such benefits are contingent upon use of the in-state 529 plan. Other state benefits may include financial aid, scholarship funds and protection from creditors.

For withdrawals not used for qualified education expenses, earnings may be subject to taxation as ordinary income and a 10% federal income tax penalty.