Money matters. Your investment options include fees and if those fees are not reasonable they will cut away from your overall investment performance affecting years of retirement.

We do not manufacture publicly sold products as do large investment firms or insurance providers. We are independent and fully disclose fees as a registered investment advisor representative of 401k Capital Advisory Group Advisory Services.

Important Note: The information contained herein is presented for educational purposes only and may not be indicative of actual situations. Each clients situation is different. The information presented is for concept illustration only.

Help Workers Understand Their Investment Options

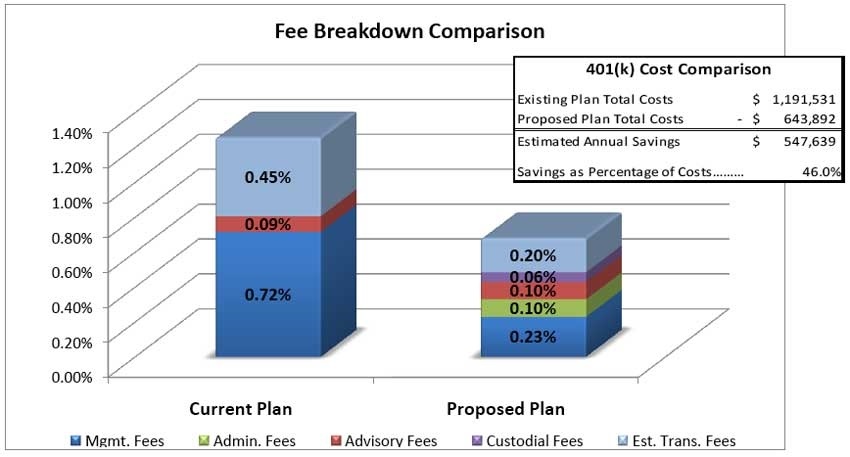

Capital Advisory may reduce the overall costs of this plan almost in half – 46 percent. In total, company and its 401(k) participants are paying $1.2 million in costs. We may be able to reduce plan costs to $644,000.

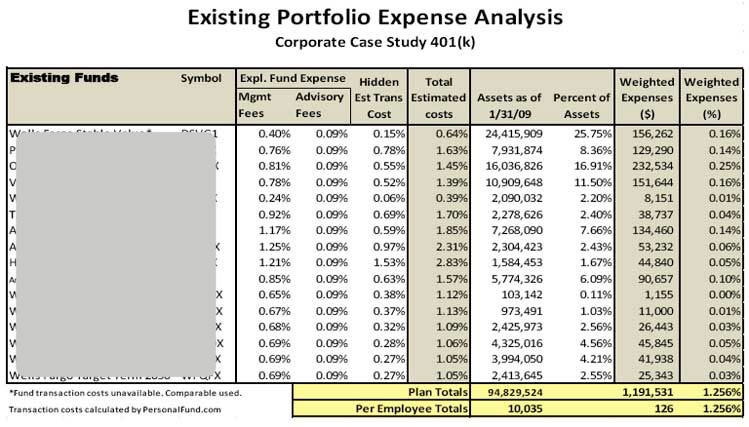

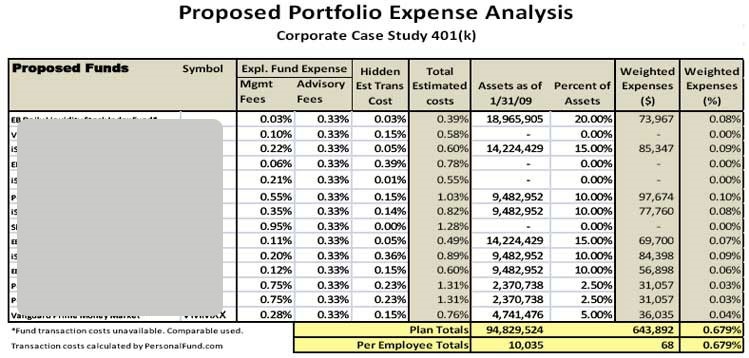

Not all the fees in this example were disclosed by the current provider. The long-term impact of disclosed and undisclosed costs in plan participants’ accounts is significant. When you consider existing plan costs as compared to our proposed plan, the 46 percent cost savings save each company employee a great deal over time.

As you will see in our case study, an employee working at current company for 30 years invested with the same allocation will end up with 16% fewer assets with the current plan as opposed to the proposed plan, just from the added costs. While retired, if that same employee withdraws from his 401(k) to supplement his Social Security, that 16% shortfall would force the retired employee to draw down his asset base more quickly. Based upon the analysis, after thirty years of retirement, the employee would consume most of his assets, leaving only $42,000 as compared to $621,000 in the proposed plan. The difference is in the fees.

Our proposed plan could reduce annual fund management fees from $678,000 to $217,000, cut transaction costs from $427,000 to $185,000, and would raise the combination of advisory, custodial, and plan administration fees from $85,000 (which does not reflect all of plan administrators compensation) to $242,000. The graph below shows how the savings add up:

— Brett Machtig, AIF®, CWS®, RMA®